Financial Literacy for College Students

Financial Literacy for College Students

In a period of profitable query and complex fiscal geographies, the significance of Financial Literacy can not be exaggerated, especially for council students who stand on the threshold of their adult lives. The transition from high academy to council marks a critical juncture where students aren’t only embarking on a trip of academic growth but are also presented with the occasion to cultivate essential life chops, including Financial Literacy. Also, read The Power of Networking in College.

Understanding Financial Literacy

The first step before leading in the content of Financial Literacy for College Students, we should understand further about it. Financial Literacy refers to the capability to comprehend and make informed opinions about particular finances. It encompasses a range of chops and Literacy, including budgeting, saving, investing, managing debt, understanding credit scores, and making informed opinions about loans and fiscal products.

For council students, acquiring Financial Literacy is consummate as they transition into majority and begin to manage their finances singly.

The Challenges Faced by College Students

- Limited Formal Education: The first challenge, in the context of Financial Literacy for College Students, is Limited Formal Education. Despite the added complexity of fiscal systems, numerous educational institutions don’t give comprehensive Financial Literacy education. This gap leaves students ill-equipped to handle real-world fiscal challenges.

- Pupil Loan Debt: The coming challenge, on the content of Financial Literacy for College Students is Student Loan Debt. The rising cost of education has led to a swell in pupil loan debt. numerous students graduate burdened by loans, frequently without a clear understanding of how to manage and repay them effectively.

- Lack of Experience: Following, the content of Financial Literacy for College Students is a Lack of Experience. College Students may be managing their finances for the first time, leading to implicit miscalculations and mismanagement if they warrant the necessary chops.

- Impulse Spending and Peer Pressure: The alternate-last challenge, on the content of Financial Literacy for College Students, is Impulse Spending and Peer Pressure. College life frequently exposes students to blink pressure and newfound independence, leading to impulsive spending habits that can have long-term consequences.

- Credit Card Abuse: Last but not least, the content of Financial Literacy for College Students is Credit Card Misuse. numerous students admit credit card offers without completely understanding the counteraccusations of credit card debt, leading to fiscal troubles in the future.

Also, read: Internship Insights in Colleges in India

Strategies for Enhancing Fiscal Literacy

- Incorporate Financial Education into Curriculum: The first strategy, on the content of Financial Literacy for College Students is Incorporate Financial Education into Curriculum. Educational institutions should fete the significance of Financial Literacy and integrate it into their class. Courses covering motifs similar to budgeting, investing, and managing debt should be offered to students.

- Online coffers and Workshops: The coming strategy, on the content of Financial Literacy for College Students is Online coffers and Workshops. Colleges can give access to online coffers, webinars, and shops that concentrate on erecting fiscal chops. These coffers can be interactive and engaging, feeding colourful literacy styles.

- Guest Lectures and Assiduity Experts: Following, on the content of Financial Literacy for College students are Guest Lectures and Industry Experts. Inviting fiscal experts, economists, and professionals to give guest lectures exposes students to real-world gests and perceptivity, bridging the gap between proposition and practice.

- Hands-On Learning: The alternate-last strategy, on the content of Financial Literacy for College Students, is Hands-On Learning. Simulations and interactive games can give students a practical understanding of fiscal opinions. These tools allow students to trial different scripts and learn from their miscalculations in a threat-free terrain.

- Particular Finance Clubs: Last but not least, on the content of Financial Literacy for College Students Personal Finance Clubs. Establishing pupil-run particular finance clubs can produce a peer-to-peer literacy terrain where students can partake in tips, gests, and Literacy.

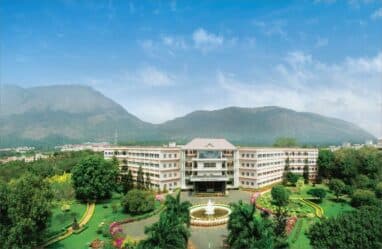

Best Engineering College: IIT Madras

Taking way Toward a fiscal commission

- Produce a Budget: The first step, in the content of Financial Literacy for College Students is to produce a Budget. Learning to budget is foundational. students should track their income and charges to ensure they’re living within their means.

- Figure Emergency Savings: The coming step, in the content of Financial Literacy for College Students, is to Build Emergency Savings. Encouraging students to establish an exigency fund can cushion against unanticipated fiscal shocks.

- Understand Credit: Following, the content of Financial Literacy for College Students is Understand Credit. students should comprehend the basics of credit, how credit scores work, and the counteraccusations of taking on debt.

- Limit Student Loan Borrowing: The coming step, in the content of Financial Literacy for College Students, is Limit Student Loan Borrowing. Adopting only what’s necessary and understanding the terms of loans can help inordinate pupil loan debt.

- Invest Wisely: Following, the content of Financial Literacy for College Students is Invest Wisely. Exploring investment options beforehand, similar to withdrawal accounts or low-cost indicator finances, can set the stage for long-term fiscal growth.

- Be conservative with Credit Cards: The alternate-last step, in the content of Financial Literacy for College Students, is to Be conservative with credit cards. However, students should pay off balances in full each month to avoid accumulating high-interest debt, If using credit cards.

- Continual literacy: Last but not least, the content of Financial Literacy for College Students is Continual Literacy. fiscal geographies evolve, so students should commit to nonstop literacy to stay streamlined on stylish practices and trends.

Also, read: Life Hacks in Colleges

Conclusion

In a decreasingly complex fiscal world, the need for Financial Literacy for College Students is consummated. Equipping students with the knowledge and chops to make informed fiscal opinions empowers them to navigate life’s fiscal challenges successfully. Colleges, educational institutions, and policymakers must unite to ensure that fiscal knowledge is an integral part of every pupil’s education.

By taking visionary ways to enhance fiscal knowledge, students can embark on their adult lives with confidence, armed with the tools they need to secure their fiscal futures.

Prakhar is a tech enthusiast with a robust background in machine learning and data science. His passion lies in converting intricate technical concepts into engaging content. During his free time, he immerses himself in reading, keeping abreast of the latest tech trends and global events, which nourishes his creativity and positions him at the forefront of innovation. Through his content, Prakhar aims to inspire others to embark on their own journeys while staying informed about the ever-evolving world of technology and beyond.