Comprehensive Guide to CA Foundation Course : Eligibility, Syllabus, and Exam Pattern

The CA Foundation Course, administered by the Institute of Chartered Accountants of India (ICAI), is a pivotal step for individuals aspiring to become Chartered Accountants. This detailed guide provides comprehensive insights into the CA Foundation exam, encompassing eligibility criteria, exemptions, registration process, fees, syllabus, and examination pattern.

Also, read 8 Myths about Chartered Accountancy

Basic Details of CA Foundation Course

- Exam Name: CA Foundation

- Conducting Body: Institute Of Chartered Accountant of India (ICAI)

- Level of Exam: National Level

- Frequency of Exam: Conducted twice a year (June | December)

- Mode Of Exam: Offline (Pen and Paper Based)

- Mode Of Registration: Online

- Number Of Papers: 4

- Medium of Exam: English/ Hindi (English compulsory for Section B of Paper 2)

- Basic Eligibility: Passed Class 12 or Appearing for Class 12 in the Current Year

- Exemptions: Graduates and Post Graduates or Candidates with Equivalent Qualification

- CA Foundation Total Fees: Varies (registration fees, examination fees, and others)

- Official Website: icai.org

Eligibility Criteria (excluding exemptions):

To be eligible for CA Foundation, candidates must:

- Enroll for the Foundation Course after passing the Class 10th Examination.

- Register for the Foundation Course on or before January 1st or July 1st for exams in May/June or November/December, respectively.

- Appear in the Foundation Examination after completing Senior Secondary Examination (10+2).

Exemptions for CA Foundation:

- Candidates with completed graduation or post-graduation are not eligible.

- Those who cleared Intermediate levels of ICSI or ICMAI cannot apply.

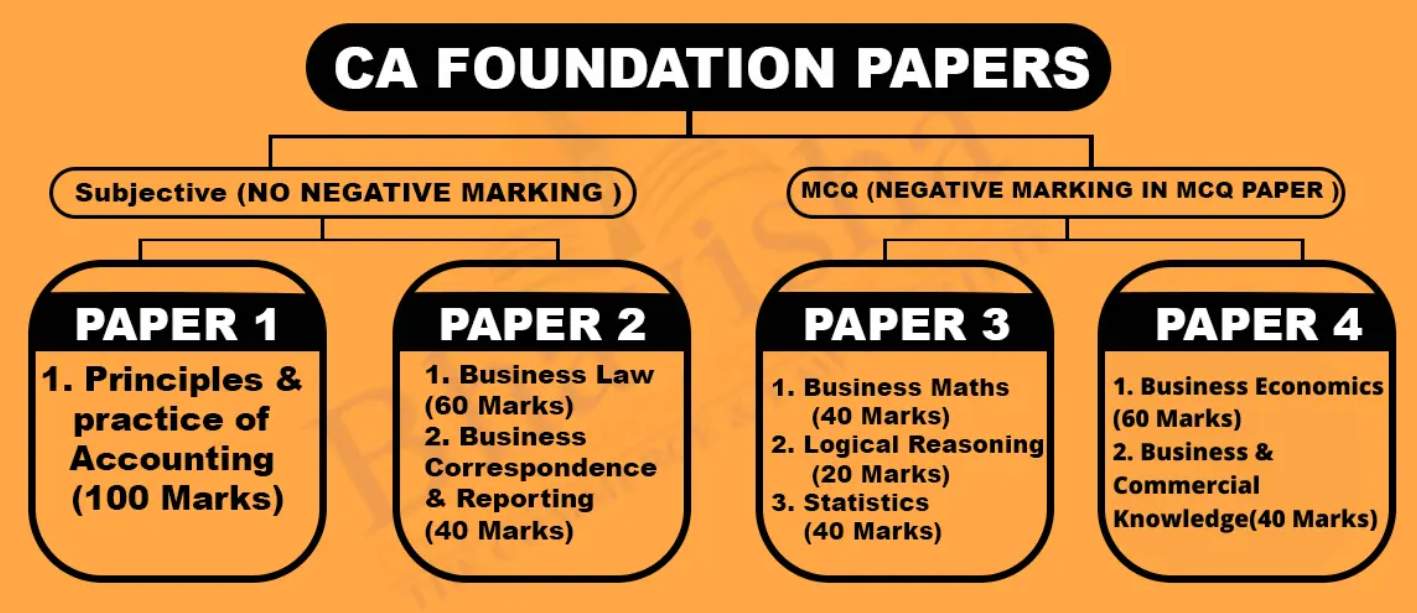

CA Foundation Course Subjects:

- Principles and Practice of Accounting.

- Business Laws and Business Correspondence and Reporting.

- Business Mathematics and Logical Reasoning and Statistics.

- Business Economics and Business and Commercial Knowledge.

Understanding Syllabus of CA Foundation:

The syllabus is extensive, covering topics such as Principles and Practice of Accounting, Business Laws, Business Mathematics, Logical Reasoning, Business Economics, and Commercial Knowledge. Each paper has specific objectives and areas to be covered.

CA Foundation Cut-off/Passing Criteria: Candidates must secure a minimum of 40% marks in each paper and 50% marks in aggregate to pass the exam.

Methodology for Achieving Passing Criteria:

- Understand the syllabus thoroughly.

- Develop a study plan.

- Refer to ICAI journals and bulletins.

- Use recommended books.

- Attend classes.

- Take periodic tests.

- Engage in self-practice.

CA Foundation Examination Pattern:

- Four papers, two subjective (Paper 1 & 2) and two objective (Paper 3 & 4).

- Each paper carries 100 marks.

- Three hours duration for each paper.

- No negative marking in Paper 1 & 2; negative marking in Paper 3 & 4.

- Papers available in Hindi and English; Section B of Paper 2 in English only.

CA Foundation Examination Schedule: Exam dates: Conducted twice a year (June | December)

CA Foundation Registration:

- Registration with the Board of Studies is the first step.

- Minimum study period of four months before appearing for the exam.

Validity of CA Foundation Registration: Registration is valid for 3 years, allowing candidates to appear six times for the CA Foundation examination.

Registration Dates for CA Foundation Examination:

Scope of Chartered Accountant

Being a Chartered Accountant opens up diverse career opportunities in finance, taxation, auditing, and consultancy. CA professionals are in demand across industries, and their expertise is crucial for financial management and decision-making.

Steps to Become a Chartered Accountant

- Enroll in the CA Foundation course after Class 10th.

- Register for the Foundation Course.

- Prepare and appear for the CA Foundation Examination.

- Complete articleship and practical training.

- Enroll for the CA Intermediate course.

- Complete the required practical training.

- Enroll for the CA Final course.

- Successfully clear the CA Final Examination.

- Complete GMCS (General Management and Communication Skills) and Advanced ITT (Advanced Information Technology Training).

- Become a member of the ICAI and receive the prestigious CA designation.

End Note

The CA Foundation examination is a stepping stone towards a rewarding career as a Chartered Accountant. This guide provides comprehensive information for aspiring candidates, covering eligibility, syllabus, and exam patterns, ensuring effective preparation for success in the CA Foundation exam. The scope of CA extends to various industries, making it a prestigious and sought-after profession. Following the outlined steps diligently can pave the way for a successful CA journey.