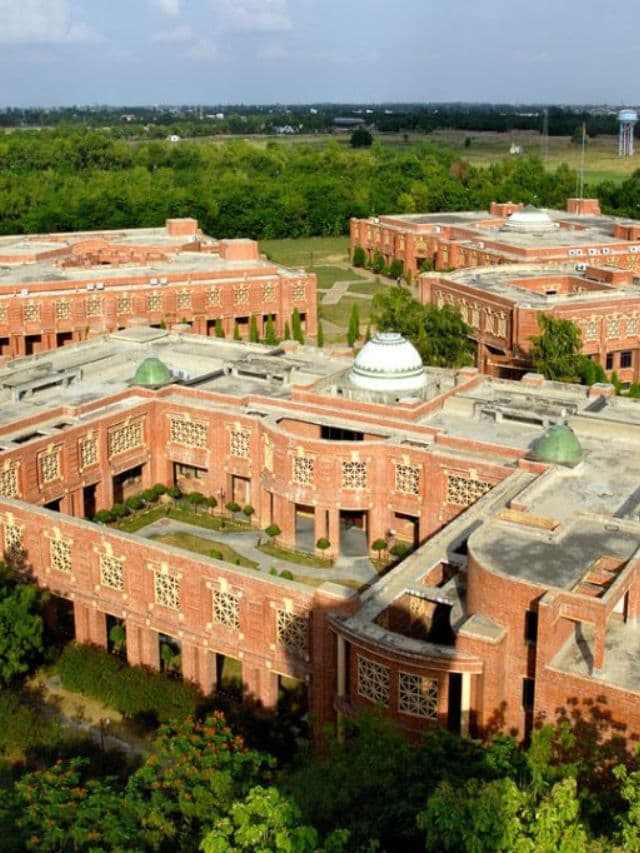

IIM Lucknow and PFRDA host a great symposium

IIM Lucknow in collaboration with the PFRDA hosted a symposium on ‘Atmanirbhar Pensioned Society for a Viksit Bharat.’

PFRDA stands for Pension Fund Regulatory & Development Authority.

This significant event addressed critical issues and opportunities within the pension sector, fostering discussions to pave the way for a self-reliant, pensioned society in a developed India, say sources from IIM Lucknow.

Senior leaders and dignitaries from the Ministry of Finance, IIM Lucknow, State Bank of India, Life Insurance Corporation of India, Kotak Mahindra AMC Limited, Delhi School of Economics, and Bank of India, were also among those who participated.

Opportunities

India’s demographic dividend, with 65% of its population in the age group of 15 to 59 years, presents both unique challenges and opportunities, say sources from IIM Lucknow.

The elderly population, currently at 10%, is expected to grow to 20% by 2050. Furthermore, the old age dependency ratio is projected to increase from 15.7% in 2021 to 20.1% in 2031.

Therefore, ensuring old age income security through pensions is not just a necessity but a significant area of focus, say sources from IIM Lucknow.

·Engage with stakeholders and eminent experts to deliberate on critical pension sector challenges

·Develop policy suggestions and action plans to enhance pension coverage and adequacy

·Promote financial literacy and sustainable pension fund investments

Chintan Shivir

The symposium served as a ‘Chintan Shivir,’ focusing on key pension sector issues such as adequacy, coverage, accessibility, affordability, financial literacy, pension fund investments and risk management, and optimal regulations.

The goal of this event was to identify actionable steps to achieve an ‘Atmanirbhar Pensioned Society for a Viksit Bharat,’ say sources from IIM Lucknow.

Additionally, the symposium marked the release of the Compendium of PFRDA Act, Rules & Regulations 2024 and the Handbook of NPS Statistics 2024.

Panel discussions in the symposium by PFRDA and IIM Lucknow

The symposium on ‘Atmanirbhar Pensioned Society for a Viksit Bharat’ featured three panel discussions featuring in-depth discussions on the economic significance of old age income security, highlighting its critical role in supporting the elderly population and contributing to economic stability.

It also explored sustainable finance and ESG investment opportunities for pension funds, aiming to balance economic growth with environmental sustainability.

These included:

· Panel discussion on “Fully Pensioned Society: Product, Coverage & Adequacy”: Chaired by M P Tangirala, Additional Secretary, DFS, MoF, Government of India, featured Prof. Vikas Srivastava, IIM Lucknow.

It also featured Prof. Mukul G Asher, Former Professor, Lee Kaun Yew School of Public Policy, NUS, Singapore, Ms. Mamta Shankar, WTM (Economics), PFRDA, Sh. Pankaj Sharma, Joint Secretary, DFS, MoF, and Dinesh Pant, ED Actuarial, LIC of India.

·Panel discussion on “Pension Fund Investments & Economic Development: Focus on Infrastructure & ESG”: Chaired by Prof. V Ravi Anshuman, IIM Bangalore featured Prof. Ashish Pandey, IIM Lucknow.

It also had Nilesh Shah, Kotak Mahindra AMC Limited, Prof. Ram Singh, Delhi School of Economics, and Dhirendra Kumar, Value Research

·Panel discussion on “Financial Literacy & Retirement Planning”: Chaired by Surender Rana, DMD (ASF) SBI, featured Prof. Ajay K Garg, IIM Lucknow.

It also had Dilip Asbe, MD & CEO, NPCI, Sh. M Karthikeyan, ED, Bank of India, and Sh. Ashok K Soni, ED, PFRDA.

Integrating pension literacy with financial literacy through media communication, engagement with FinTech companies, and outreach programs will help increase coverage from the current 37.16 crore beneficiaries of funded pension schemes to achieve pension saturation, say sources from IIM Lucknow.

Policy

The symposium culminated in the formulation of policy recommendations and strategic plans to achieve a self-reliant, pensioned society, addressing the challenges and opportunities within the pension sector to create a more secure and prosperous future for all.

S Vishnu Sharmaa now works with collegechalo.com in the news team. His work involves writing articles related to the education sector in India with a keen focus on higher education issues. Journalism has always been a passion for him. He has more than 10 years of enriching experience with various media organizations like Eenadu, Webdunia, News Today, Infodea. He also has a strong interest in writing about defence and railway related issues.